Why Commercial Multifamily Properties Are Today’s Smartest Investment

Commercial multifamily for sale represents a stable and profitable opportunity in today’s real estate market. For investors looking to diversify or make their first commercial purchase, understanding the landscape is the first step toward generating consistent rental income.

Quick Answer: Where to Find Commercial Multifamily Properties for Sale

- Online Marketplaces: Search national platforms listing hundreds of multifamily properties.

- Commercial Brokerages: Partner with specialized firms for access to curated listings and market expertise.

- Property Auctions: Find distressed or bankruptcy sales with significant value-add potential.

- Off-Market Deals: Connect with brokers who have exclusive listings not publicly advertised.

- Price Range: Properties can range from under $700,000 for small buildings to over $20M for large complexes.

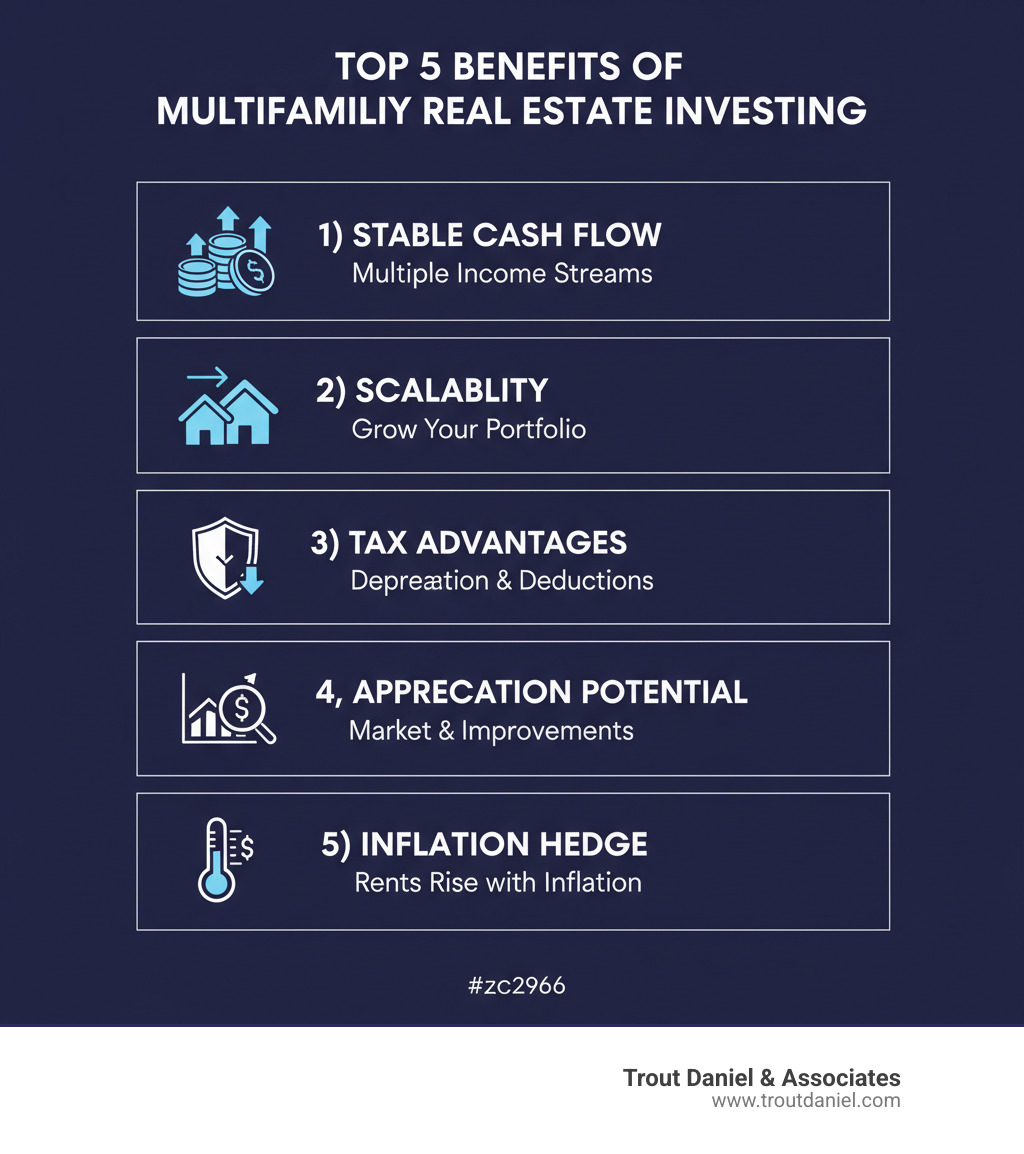

Why Multifamily Stands Out

Multifamily properties offer unique advantages. Housing demand is inelastic, and renting is an attractive option for a mobile workforce, ensuring high demand. Unlike single-tenant commercial spaces, multiple units provide a buffer against vacancy, ensuring more consistent cash flow.

What Makes This Market Different Now

The multifamily sector has shown remarkable resilience, thriving while other sectors struggle. Build-to-Rent developments are achieving near 96% occupancy rates. With options ranging from duplexes to large apartment buildings, investors can find opportunities at every scale.

Your Path Forward

Finding the right property requires understanding market trends, financial metrics, and local regulations. You must know the difference between Core investments (stable, high occupancy) and Value-Add opportunities (potential for improvement). This involves evaluating cap rates, analyzing neighborhoods, and navigating complex commercial financing.

Understanding the Current Multifamily Market

The multifamily market is dynamic, and understanding its currents is essential when searching for commercial multifamily for sale.

The good news is that rental demand remains strong. People need places to live, and renting is the preferred choice for millions, from young professionals to downsizing empty-nesters. This keeps the tenant pool large and growing.

However, challenges exist. Rising operating expenses—from insurance and utilities to taxes and maintenance—are squeezing profit margins. You must analyze the full cost of operations, not just rental income. Population shifts are also reshaping opportunities, with people moving from expensive coastal cities to more affordable Sun Belt metros and suburban communities. Smart investors follow these demographic waves.

How the Economy Shapes Opportunity

The economy dictates much of the multifamily market. Interest rates are a major factor; higher rates increase borrowing costs, which can cool transaction activity but also create buying opportunities for well-capitalized investors. Inflation drives up operating costs but also pushes rents higher, creating strong revenue potential. However, this contributes to the housing affordability crisis, which could lead to policy changes. Job growth is a key indicator of future demand. Cities with strong employment fundamentals consistently outperform, so investors should look where jobs are going.

Key Market Trends to Watch

Several trends are reshaping multifamily investing.

The Build-to-Rent trend is booming, with purpose-built rental communities achieving near 96% occupancy. Tenants get the privacy of a home without the burdens of ownership, and investors get stable returns.

Senior housing demand continues to grow with the aging Baby Boomer population, though this sector has unique complexities and operating costs.

A focus on amenities is now standard. Features like fitness centers, co-working spaces, and dog parks are expected by renters and allow properties to command premium rents.

Technology integration, from smart locks to online rent payment, is improving the tenant experience while cutting operational costs and boosting financial performance.

Types of Commercial Multifamily for Sale

When exploring commercial multifamily for sale, you’ll find a wide variety of properties, each with unique opportunities. Understanding these differences helps match your investment goals with the right asset. Properties exist on a spectrum, from small 2-unit duplexes to massive 177-unit apartment towers.

Property classes help with evaluation. Class A properties are the newest and command top rents. Class B are well-maintained older buildings in good neighborhoods. Class C are older buildings needing work but offering substantial return potential.

Your investment strategy also matters. Core investments are stable properties with high occupancy (90%+). Value-add opportunities have moderate occupancy (60-90%) and renovation potential. Opportunistic plays involve properties with low occupancy (

Specialized types include student dormitories and manufactured housing communities.

Small-Scale Properties: Duplex, Triplex, and Fourplex

These 2-4 unit properties are a common starting point for investors. The entry barrier is lower, making them more accessible. They often qualify for owner-occupant financing, where you live in one unit and rent out the others, letting tenants cover your mortgage. Management is straightforward and can be hands-on, providing invaluable experience in the day-to-day realities of multifamily ownership.

Mid-Size Communities: Garden and Low-Rise Apartments

With 5-50 units, these properties offer a balance of manageable complexity and significant cash flow.

Garden-style apartments are typically 2-3 stories spread across landscaped grounds, offering a quieter, suburban feel.

Low-rise buildings are generally four stories or fewer and work well in both urban and suburban settings, offering good density without the cost of elevators.

At this scale, most investors hire professional property management to handle daily operations. The income justifies the management fees, and amenities like shared laundry or a fitness room become feasible, helping attract and retain quality tenants.

Large-Scale Investments: Mid-Rise and High-Rise Buildings

Properties with 50+ units are institutional-quality investments, with prices in the millions.

Mid-rise apartments (5-12 stories) offer economies of scale, where per-unit operating costs drop.

High-rise complexes (12+ stories) can define skylines and reshape communities, like the $3.8 billion Bronzeville Lakefront project in Chicago.

Amenities in these properties can rival luxury hotels, which is essential for commanding premium rents in competitive urban markets. The capital requirements are substantial, often requiring partnerships or institutional backing, but the potential returns match the scale.

Key Factors for Evaluating a Multifamily Investment

Before committing to any commercial multifamily for sale opportunity, thorough due diligence is critical to avoid costly mistakes. Proper evaluation covers three areas: location and market, financial performance, and physical and legal condition.

Location, Location, Vocation

A property’s location determines its tenant pool, rental rates, and long-term performance.

- Neighborhood Analysis: Assess the area’s vibrancy, demographic trends, and population growth.

- Proximity to Employment: Properties near major employers or business districts have consistently strong demand.

- School Ratings: Top school districts attract families and indicate a stable, desirable neighborhood.

- Transportation Access: Easy access to public transit and major highways is a competitive advantage.

- Future Development: Research city plans for infrastructure or new businesses that could increase property values.

Financial Due Diligence for a commercial multifamily for sale

The numbers are where deals are made or broken. You must understand a property’s true potential and risks.

- Net Operating Income (NOI): This is your property’s earnings after operating expenses but before debt service. It’s the purest measure of performance.

- Capitalization Rate (Cap Rate): Calculated as NOI divided by property value, this provides a snapshot of expected return. Cap rates for commercial multifamily for sale can range from under 4% for prime, low-risk properties to over 11% for high-risk, value-add opportunities. A “good” cap rate depends on the market, property class, and your strategy.

- Cash-on-Cash Return: This measures cash flow relative to your actual cash invested, which is especially important when using leverage.

- Occupancy History: Look for consistent high occupancy over several years, as volatility can signal underlying problems.

- Rental Comps: Compare current rents to the market. Below-market rents may signal a value-add opportunity.

Be aware of market dynamics like cap rate expansion and rising expenses in some sectors, which impact returns.

Property Condition and Legal Review

Physical or legal issues can destroy returns. A thorough inspection is non-negotiable.

- Major Systems: Focus on the age and condition of the HVAC, roofing, plumbing, and electrical systems. Recent upgrades can eliminate major near-term capital expenditures.

- Deferred Maintenance: Look beyond cosmetic issues for structural problems, water damage, or outdated systems.

- Zoning Regulations: Ensure the property’s zoning aligns with your investment strategy, especially for redevelopment or conversion projects.

- Tenant Leases: Review every lease to understand terms, expiration dates, and rent levels to accurately project income.

- Service Contracts: Examine all ongoing contracts for utilities, maintenance, and management to understand inherited obligations and costs.

Strategies for Acquiring Your Property

Finding the right commercial multifamily for sale is only half the battle; successfully acquiring it is the other. This requires knowing where to look and how to structure a deal that maximizes your returns.

Finding the Right Opportunity

The best deals aren’t always in plain sight.

- Broker Networks: Experienced commercial brokers provide access to listings before they hit the open market and offer invaluable local market knowledge.

- Online Listing Platforms: These sites have democratized access to hundreds of listings nationwide, allowing you to filter by location, price, and other criteria.

- Off-Market Deals: These are properties not publicly advertised. Cultivating relationships with owners and brokers can lead to exclusive opportunities without competitive bidding.

- Property Auctions: Bankruptcy and foreclosure sales can offer attractive entry points for investors comfortable with distressed assets and value-add strategies.

Securing Financing for a commercial multifamily for sale

Creative and effective financing can be the difference between a good investment and a great one.

- Conventional Commercial Loans: Offered by banks and credit unions, these typically require 20-30% down and are best for stabilized properties.

- Government-Backed Financing: Programs from Fannie Mae and Freddie Mac offer competitive terms, including lower interest rates and longer amortization periods, for well-performing properties.

- Seller Financing: This flexible option, where the seller provides the loan, can help in acquiring properties that might not qualify for conventional financing.

- Bridge Loans: These short-term loans are ideal for value-add projects, funding the acquisition and renovation before you refinance into a permanent loan.

- Joint Ventures: Pooling resources with other investors allows you to tackle larger deals and share both risk and reward.

The key is matching the right financing strategy to your property and goals, where an experienced advisor is invaluable.

Frequently Asked Questions about Multifamily Investing

After years of guiding investors through commercial multifamily for sale transactions, certain questions consistently arise.

What is a good cap rate for a multifamily property?

There’s no single answer. A “good” cap rate depends on the market, property class, and your investment strategy. In prime markets, a low-risk Class A property might trade at a 3.66% cap rate. In contrast, a high-risk, value-add property in an emerging market could exceed an 11% cap rate. A good cap rate is one that aligns with your risk tolerance and return expectations for that specific asset.

How many units are considered ‘commercial’ real estate?

Properties with five or more units are classified as commercial real estate. Anything with one to four units is considered residential. This distinction is critical because it affects financing, regulations, and tax treatment. Commercial loans are underwritten based on the property’s income potential, not just personal credit.

What are the biggest risks in multifamily investing?

While stable, multifamily investing is not risk-free. Key risks include:

- Market Downturns: Recessions can decrease demand, increase vacancy, and lower property values.

- Vacancy Rates: Prolonged vacancies across multiple units can quickly erode cash flow.

- Unexpected Capital Expenditures: Major repairs to systems like roofing or HVAC can be costly surprises. Thorough inspections are crucial.

- Problem Tenants: Non-payment, property damage, and legal disputes are costly and time-consuming. Proper screening and management are key defenses.

- Regulatory Changes: New laws like rent control or zoning restrictions can impact profitability. Staying informed on local regulations is essential.

Understanding these risks allows you to prepare and mitigate them with a solid team and strategy.

Conclusion: Partnering for Success in Your Multifamily Search

The commercial multifamily for sale market offers a clear pathway to building wealth through stable income and long-term appreciation. Opportunities exist at every scale, from small fourplexes to large apartment complexes, driven by strong rental demand.

However, navigating this landscape is complex. It requires understanding everything from cap rates and operating expenses to zoning laws and financing structures. Success depends on thorough due diligence and a clear strategy. This is where having the right partner makes all the difference.

At Trout Daniel & Associates, we’ve spent over three decades helping investors master these challenges. We provide genuine boutique service, meaning you get one-to-one consultation from an advisor who knows your portfolio and prioritizes your success. Our experience spans multiple jurisdictions, giving us the insight to guide you through diverse markets.

Whether you’re scaling up, diversifying, or making your first acquisition, we’re here to help you identify, evaluate, and acquire properties that align with your investment objectives. We don’t just find deals—we help you build a winning strategy.

Ready to explore what’s possible in the multifamily market? Find your next multifamily investment with our expert advisory services. Let’s discuss your goals and how we can help you achieve them.